Introduction

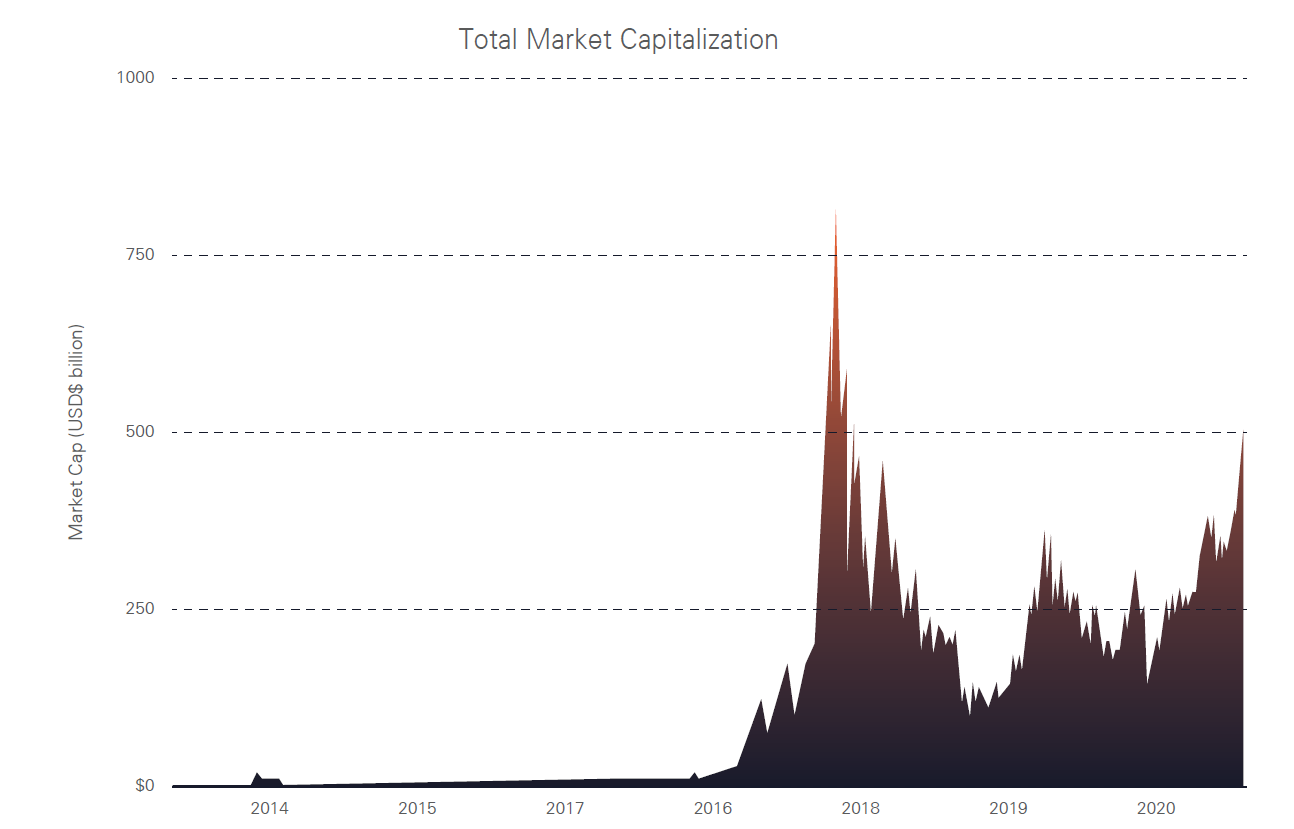

Blockchain assets have enjoyed explosive growth with the market cap increasing by 4000% since 2013¹. 2020 heralded a massive shift in adoption with large organizations including PayPal, Square, and others accelerating the uptake of cryptocurrencies by supporting them as a form of payment for 300,000+ users.

By 2020 it became clear that crypto assets were no longer the exclusive domain of retail investors with overall growth propelled by an influx of venture capital funding and large-scale institutional investment.

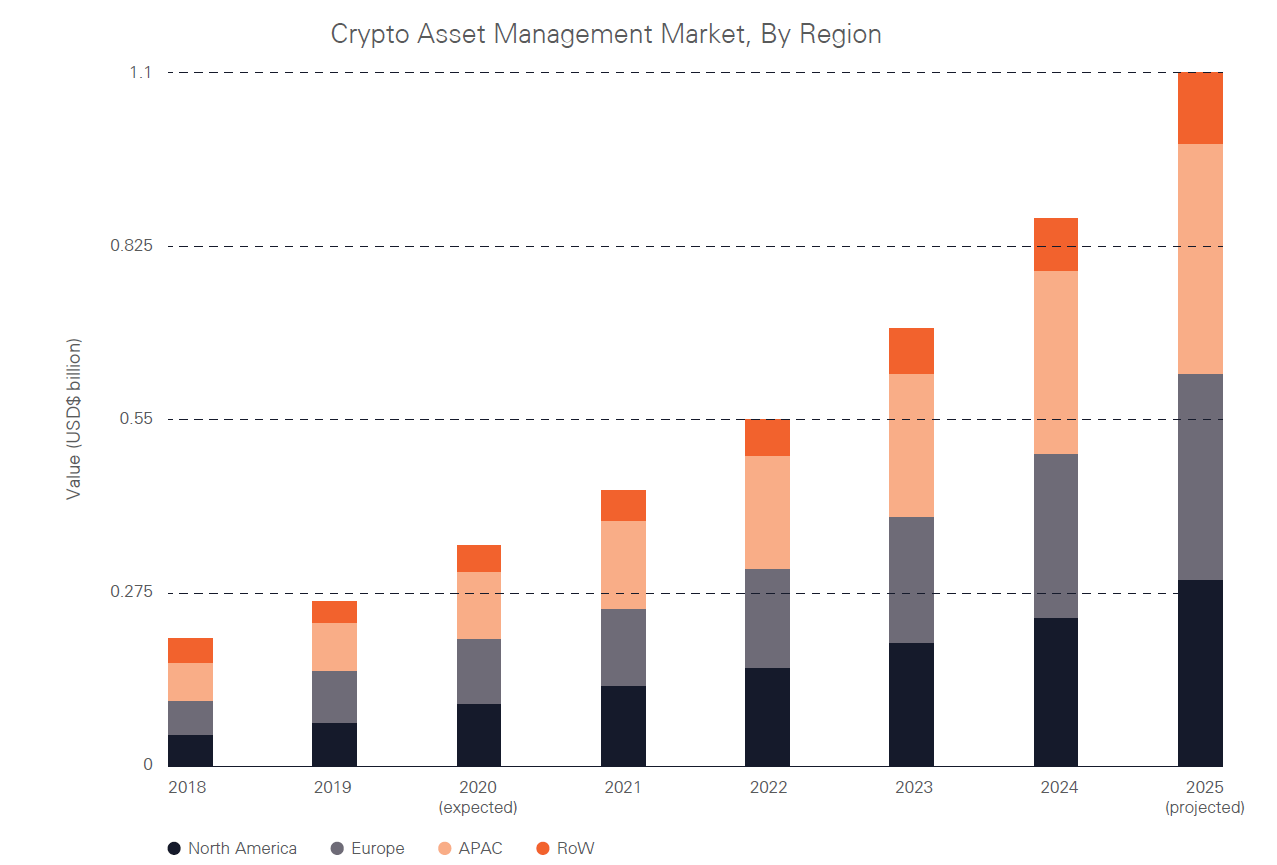

Strong growth is predicted throughout the next decade as traditional services and technologies pivot towards blockchain and crypto native enterprises continue to rise. This ongoing adoption will necessitate the development and uptake of new methods for crypto asset management, treasury solutions, investment, and day-to-day banking operations for crypto assets.

The increasing venture capital funding and growing investments in crypto asset management technology is a key factor in driving market growth². Industries such as Financial Services, Healthcare, Retail, eCommerce, Travel, and Hospitality are expected to adopt crypto asset management solutions at the highest rate. Companies across Asia-Pacific will benefit from flexible economic conditions, favourable government policy motivated by industrialization, and growing digitalization, which is expected to have a significant impact on the business communities in those regions.

Crypto asset management solutions enable businesses to secure their digital assets and streamline business operations. These use cases may be categorized as:

Crypto asset treasury by financial institutions

Using crypto to facilitate day to day operations