The Decentralized Finance Challenge

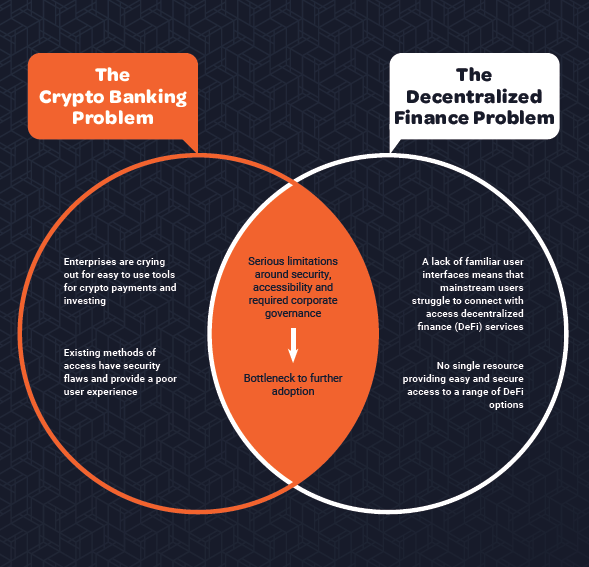

Enterprise and financial institutions holding crypto-assets can capitalize on DeFi to gain yields from those assets – rather than solely relying on price appreciation but accessing DeFi requires a high level of technical knowledge and is often delivered with a poor user experience.

DeFi has enabled retail investors to lend their crypto assets in exchange for interest payments - and it should for the same for enterprises as well! This attractive opportunity to utilize idle crypto assets to make a return has grown massively in the last 12 months and yet access to this opportunity has been restricted to a niche of tech-savvy retail crypto adopters and has meant enterprise bodies simply miss out on the benefits.

The key challenge for enterprise users is that the current solutions that grant access to DeFi for retail investors require them to store their assets on a particular platform. Enterprises, however, as discussed above, require significantly higher security features, governance mechanisms, and interoperability while either managing their crypto treasury or their day-to-day business.

Critics agree that for this growth to continue, DeFi must move beyond the early adopter market of tech-savvy retail crypto users and make itself accessible to the enterprise community. For DeFi to thrive, it must enter the mainstream and attract enterprise users who do not tolerate nor understand DeFi’s geekiness⁵.

DeFi is still a relatively new phenomenon and users must interact with interfaces that are technical and poorly documented. To gain widespread adoption DeFi needs to be brought into the fold of mainstream financial services - including better user interfaces and more accessible products and services.

To gain widespread adoption DeFi needs to be brought into the fold of mainstream financial services - including better user interfaces and more accessible products and services.

“DeFi needs interfaces that are familiar, intuitive, and enjoyable”...”they should lay them underneath the hood of applications that are consumer- friendly, like mainstream platforms or online banking services”.

The problem is highlighted by the incumbent platforms. For example, to interact with Yearn Vault, a new user can only choose from a limited array of wallets from which to trade from. However, the system is not user friendly and requires several interactions to deposit or withdraw funds. The process lacks documentation, is relatively insecure, time consuming and does not inspire confidence in the use of the platform.

...for DeFi to thrive, it must enter the mainstream and attract enterprise users who do not tolerate nor understand DeFi’s geekiness⁵